Geomarketing in Competition Law

Geographic Market Analysis Faster, More Efficient and More Accurate

In merger control procedures, the market concentration is often estimated by analyzing catchment areas of the participating companies, so-called isochrones. WIGeoGIS tools and know-how have proven extremely helpful for the calculation and presentation of these analyses.

Case Study Overview

Customer: Schoenherr Attorneys at Law

Application: Competition law, merger control proceedings

Product: Custom geographic market analysis

Goal: Assessment of market concentration, preparation of well-founded data for submission to the competition authorities

“With WIGeoGIS as our partner, we receive a faster, better and more cost-effective database for our work with the competition authorities. This contributes significantly to transparency and success in merger control proceedings.”

Dr. Hanno Wollmann, Schoenherr Attorneys at Law

Company mergers must be approved by the competition authorities if they reach a specific size. Depending on the sales, responsibility lies either with the European Commission or at national level.

The national competition authorities, such as the German Federal Cartel Office or the Austrian Federal Competition Authority, primarily focus on the small-scale consideration of local markets in numerous industries, such as retail or building materials. In such cases, isochrones have become established as the preferred analysis tool for estimating the market concentration.

Overlap Analysis Using Isochrones

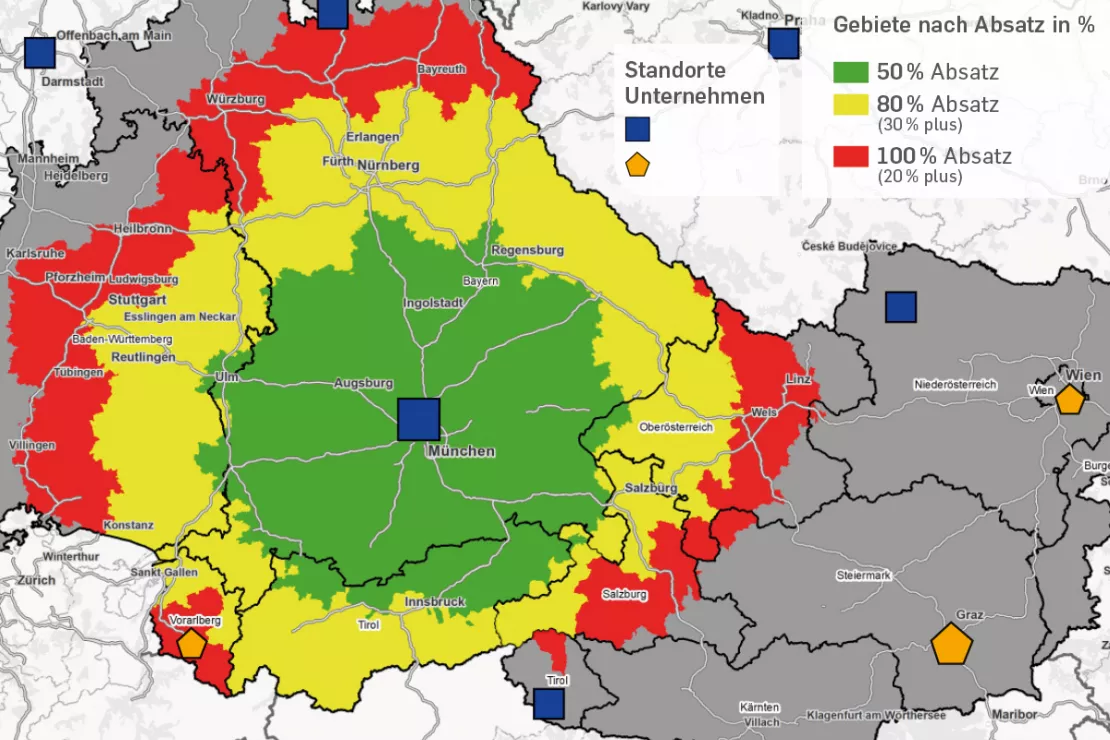

Isochrones are catchment areas of production and distribution locations, measured in distances or travel times. “A common question is how large is the area in which 80% of the customers of a manufacturing facility are located, or in other words, the location where 80% of its sales are generated,” explains Hanno Wollmann, Partner at Schoenherr Attorneys at Law in Vienna and expert in the field of competition law.

“When working with the competition authorities, it is ideal if the calculated isochrones can be displayed on a map. That way, officials can see at a glance where there is overlap between the catchment areas of the companies involved and in which regions the case is harmless from the outset. This is a first step where the geomarketing experts from WIGeoGIS can make our job much easier,” says Wollmann. “For them, making maps that tell you how far you can drive from a specific location in 30 or 60 minutes by car is easy.”

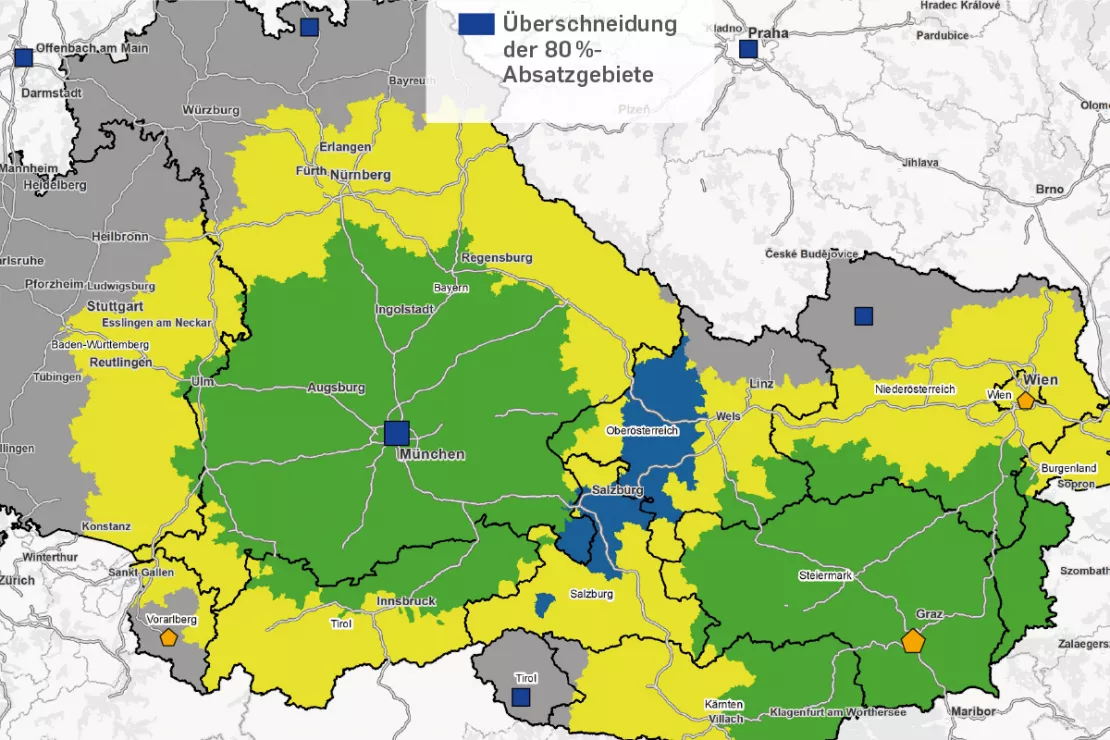

Geographic Market Analysis

It gets exciting where the isochrones of two locations overlap, because the market shares in the overlapping areas are decisive for the competition authorities. For this purpose, the isochrones are supplemented with the sales data of the locations (sales in euros or sales in units or quantities) and calculated in relation to the total market volumes. “With their programs, WIGeoGIS can process the raw data from our customers and link it with the isochrones much more easily than we ever could,” explains Wollmann. In addition, the company can provide data on total market volumes with the data they are able to access for example through Statistics Austria or Eurostat.

Initial situation of a company merger. The blue locations are owned by the company A. The orange locations are potential merger locations with Company B. The lines represent the current sales streams for each location. The map shows regional markets without overlap and those regions served by both companies. These are of interest in terms of competition law.

Curious? We are happy to provide a personal consultation!

Custom Methods

“We have a multitude of tools, methods and data sources,” adds Kai Barenscher, Senior Consultant at WIGeoGIS, looking back on a series of successful projects in competition law. “Together with the client, we calculate different variations and find the best method for each individual case, often after several iterations.” He explains what he means with the help of an example: “Instead of working with political districts, road network-based catchment areas often lead to more reliable key figures for the client. At the same time, this is more realistic, because in real life the street I take to reach a hardware store is more important than the district border.”

“With WIGeoGIS as our partner, we receive a faster, better and more cost-effective database for our work with the competition authorities. This contributes significantly to the transparency and success of merger control procedures,” summarizes Wollmann.

WIGeoGIS Managing Director Wolf Graf sees the topics of mergers & acquisitions and competition law as a good example of the fact that the universal tools from geomarketing can be applied to a wide range of topics. “This explains why even ʻold hands’ in geomarketing are opening up a new business field after more than 25 years.”

Yellow and green together show the market in which 80% of the sales of the respective location are made. The blue area is the result of the market definition analysis and represents the overlap area of the two 80% isochrones. The area is under the influence of both locations and, in the case of a merger, requires a competitive assessment.

Market analysis - further case studies and information

Crédit Agricole: Market potentials via GIS

To keep up with the constantly growing needs of microgeographical analyses, the Polish subsidiary of Crédit Agricole uses a GIS by WIGeoGIS.

Market Analysis Tool

How to successfully perform 6 different analyses. Anyone who does business, must know their market. WIGeoWeb helps to answer the question of "WHERE?"

Analyze Market Penetration

With geomarketing you can find potential customers, turnover and sales! Compare your company key data with current market data on a small scale.

Market Analysis: Schedule a free consultation!

- FREE initial consultation on market analysis

- Non-binding, without further obligations

- By telephone or video call