Market Analysis Tool

How to Successfully Perform 6 Different Analyses on Interactive Maps with WIGeoWeb

Anyone who does business, must know their market. WIGeoWeb informs you about market shares, target groups, competition and market penetration. The big advantage over other market analysis tools: The data can be viewed at any spatial level. Analyze markets globally, in a single country, region or zip code.

Do you know your market? - Why the question of “Where?” provides so many answers

What is a market analysis and what do I need it for?

If you, as a business, sell a product or service in a market, you should know this market. A comprehensive market analysis tool consists of several individual analyses and answers questions such as:

- What does my target group look like and where can I find them?

- How high is my market share?

- How big is my market/my market volume?

- What is my market penetration?

- Who is my competition and what are their strengths and weaknesses?

- How can I best serve my customers with the available resources?

It is not always necessary to answer all of these questions at the same time. When you launch a new product, there is no way around performing a thorough market analysis. However, existing companies that sell established products also have to continually pay close attention to their market. Depending on your needs, you focus on the current partial aspect.

Heart of Business Planning

The clearer the factors that influence your business, the better you can manage it. Market analyses are at the heart of business planning and are the basis upon which you make your decisions:

- Strategy

- Marketing

- Sales

- Locations

The right market analysis tool combines data from different sources, creates valid analyses and delivers understandable results.

Market Analysis - This is what you can expect on this page

Here, we will show you how to use spatial analysis to examine your market and the special benefits spatial data can provide. For we are specialists in market analysis and work with geomarketing, which means that we use the spatial aspects of data to gain insights that allow you to better manage your company. It works very well.

We will show you 6 different analyses, focusing specifically on spatial aspects. We will also provide you with tips on what is important and what you should not forget.

Table of Contents

Market Analysis Tool WIGeoWeb - The Benefits

There are many market analysis tools. Most have one thing in common: analyses are created for the company hierarchy, product groups and/or time periods. Spatial and regional aspects are neglected. For example, if you work exclusively in Germany, but nationwide, and use a common tool for your analysis and the customer data from your management systems such as ERP or CRM, you will often only receive key figures related to the whole of Germany or your company hierarchy.

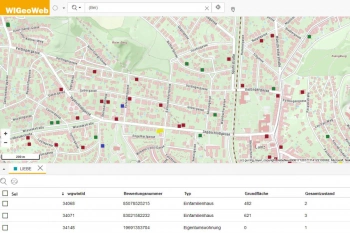

WIGeoWeb works with the coordinates of a data record, i.e. with the location (address), and shows you the data geographically on a digital map. Global, national, regional, local – exactly how you need it. Spatial relationships such as neighborhood and accessibility become visible and can be factored into the evaluation.

Why does it work so well? – Because 80% of all data records in companies have a spatial reference!

A Market is Always a Space

This also applies if you sell your products exclusively online, because the customers who buy from your web shop, live in one location (B2C) or have a branch location (B2B). The same applies to sales figures – Where was the product sold?– and characteristics of target groups, because characteristics belong to people, and people, as we mentioned above, have an address.

Understand Data at a Glance

The brain processes images in a fraction of a second, but it takes longer to process text. Digital maps can therefore be interpreted much better than tables. In Vienna, for example, the 2nd district borders the 1st, as well as the 20th district. And whoever thinks that the 22nd district is next to the 23rd is wrong: While the one is in the far east, the other is in the southwest. If your headquarters are somewhere completely different and you want to plan your sales areas, then you either need someone from Vienna or a WebGIS: You can see at a glance which districts, municipalities or ZIP codes are located together.

If you want proof, go ahead and see for yourself with the test in this video.

View Data at Every Spatial Level – Even on a Small Scale

Knowing the figures for all of Austria is sometimes not enough if the purchasing power in the west is higher than in the east or your market shares differ greatly from region to region. Or if you are not the Country Manager, but the Regional Manager for Styria. Then you want to evaluate your sales or market share on a small scale, for example by municipality or ZIP code.

This is possible with WIGeoWeb. You decide how much detail you need. If necessary, all the way down to grid cells of 100 x100 m.

Tip!

Think carefully about which spatial level is the most suitable for your analysis, especially if you need to buy external regional data. A common mistake that many make when starting market analysis is to use whatever data they can get. However, the granularity has to correspond to the question. Data that is too small can dilute the meaningfulness of the results. If you are not sure, we will be happy to consult you!

More on spatial levels: Germany, Austria

Everything in a single tool ...

In large companies, it can be very useful to be as flexible as possible when viewing the data. The individual departments such as marketing and sales have different needs, and the area you want to analyze can be as large as EMEA (Europe, Middle East, Africa) or as small as a single district. Once the data is in the system, each department and employee can scale the results to match their needs. The sub-markets being analyzed are as different as the roles in the company.

... the Market Analysis Tool WIGeoWeb

The software for spatial analysis is the GIS (Geo Information System). The most practical and common form today is the online version, WebGIS like WIGeoWeb. It can easily be used in a web browser on any device that is connected to the internet. With WebGIS, numerous common market analyses can be carried out, centrally in one system.

Test WIGeoWeb for free. All functions of the Market Analysis Tool are included.

Comprehensive Market Analysis With 6 Different Analyses

When analyzing the market using geomarketing, i.e. with WebGIS, the key question is “where?”

We will now show you 6 of the most common analyses as part of a comprehensive market analysis. They are all good for viewing spatial data and can be done with WIGeoWeb. Once you have carried out these 6 analyses, you will have a very holistic understanding of your market that will form the basis for you to make informed decisions for your company. The order is not fixed and depends on your current needs. The questions behind the analyses however, are very familiar to everyone in business.

Tip!

Follow a carefully thought out and structured approach. It may sound obvious, but it is often neglected. Only those who know the goal can achieve it.– What do I want to know? How exactly do I need to know?

Do not underestimate the effort required for a market analysis and use your resources wisely. Formulate your questions carefully as they are crucial for the rest of the process such as the selection of the type of analysis, methods, tools and data that you will use.

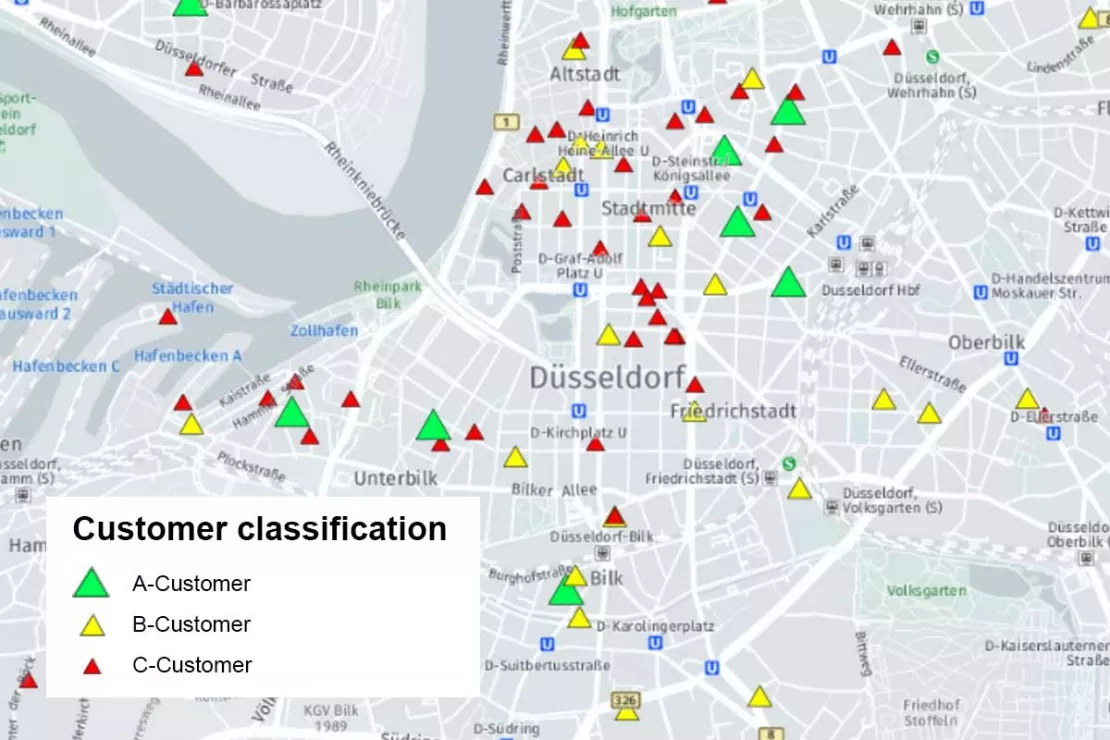

1. Customer Analysis

With customer analyses, you are dealing with the data of your existing customers, i.e. company data from your management systems. It is about gaining clarity on “good” and “bad” customers and gaining knowledge about customer satisfaction. Measures can be derived from this for both customer retention and new customer acquisition.

Good customers are profitable and they are loyal. Customer loyalty is important because winning a new customer is five times more expensive than keeping an existing one.

Sales are included in the determination of the customer value, but also the costs for customer service. An ABC analysis is suitable for determining the customer value: According to the Pareto rule, the top 20% of the customers generate 80% of the sales.

Questions Answered by a Customer Analysis

- Where are my customers?

- Where are the good and where are the bad customers?

- Which customer groups do I have, and how are they distributed regionally?

- How are my A customers given optimal service? Where can I optimally use my resources for customer service?

- Which B customers can I turn into A customers?

- Are there any changes in my sales / regional structure?

The spatial distribution plays a major role in this type of market analysis, because it has an impact on your sales and marketing. Regardless of whether you have a sales force, operate branches or work with a dealer network, you can gain a lot of knowledge from the spatial distribution of your customers that will allow you to better manage your company. The customer database has a coordinate and is well suited for displaying geographical data. We often experience when someone sees their own CRM data on the map for the first time: “Oh, now I understand!” Because company data is often extensive and therefore difficult to read. What was previously hidden, can now be seen at a glance.

Test for yourself - Analyze Customer Shares with WIGeoWeb

2. Target Group Analysis

Even before you have built up a customer base, you will probably deal with your target groups. You know your product. But do you also know who buys it? Here we mostly speak of end customers and characteristics. The most important characteristics are age, purchasing power, sometimes gender and, as basic it as it may seem, the number of inhabitants (where do a lot of people live?). There is data on hundreds of characteristics, so you can also search for singles, garden owners, apartment buildings, high car density and purchasing power for certain product lines, or you can combine two or more characteristics.

Even if you have been in business for a long time, you will be concerned with target groups again and again. Very often it is about developing measures for marketing and advertising, but it is also important for sales planning to know where the target group can be found. When you make decisions and changes, they can be easily justified by the results of the analyses.

Questions Answered by a Target Group Analysis

- Where can I find my potential customers/buyers?

- Where can I find a high number of women aged 45-64 with a high purchasing power?

- Where is the purchasing power for consumer electronics particularly high?

- I know where my sales are good. Why am I selling well there, what are the common characteristics of these customers?

Characteristics also always have a spatial reference, a distribution that can be represented geographically. WebGIS shows you geographically, for example, the distribution of male residents in Germany as well as their purchasing power. Again, you can perform a large-scale or small-scale analysis at the ZIP code or grid level based on your specific needs. You can place the two characteristics on top of each other and form an intersection (overlay analysis). The result can be exported as a table and further processed (e.g. by your advertising agency, which controls your campaigns), but the numbers can be interpreted much more easily by looking at the map.

This type of market analyses saves some companies expensive market research, which could be purchased externally or done internally, but both are time-consuming. The company’s own data is usually not sufficient for target group analyses, so you will need demographics. These are available in high quality for both the German and Austrian markets (and internationally if required).

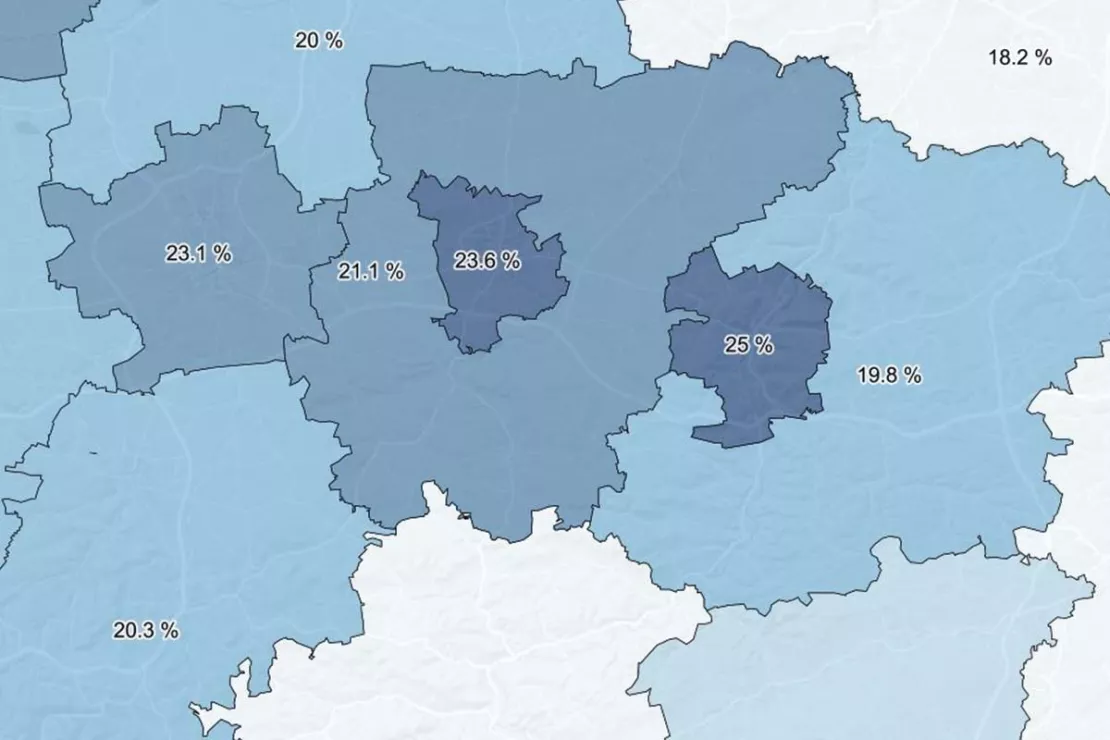

Questions Answered by Determining the Market Shares

- What is my absolute market share (= based on the total market volume)?

- What is my relative market share (= based on the largest competitor)?

- How are my sales distributed? Where am I doing well? Where am I doing poorly? What can I conclude from this?

For example in the picture on the right: The darker, the higher the market share there.

Tip!

Do not be afraid of incomplete/imperfect data. All the information is not always available. Try to get as close as you can, because “fuzzy” data is better than no data! Knowing that there are inaccuracies in the analysis will help you more than no market analysis at all.

Test for yourself - Calculate Market Shares with WIGeoWeb

4. Market Penetration Analysis

So far we have been working with actual sales. Market penetration analysis is about sales/turnover forecasts for the future. In the example above, where you sell 50 car batteries in district X, your market volume is 200 batteries because you know the number of cars and each car has a battery. However, the market penetration could be higher, namely if the market for cars grows, so it can be expected that the number of cars will increase. In the early days of mobile communications, only a few mobile phones were sold in relation to the number of inhabitants. The market later developed so that multiple devices were possible per inhabitant. Market exploitation indicates the extent to which potential possible customers of a product actually consume it.

It is clear that you have to make assumptions for a penetration analysis. Surveys can show how much demand there is for a product that is still unknown.

Questions Answered by a Market Penetration Analysis

- What is the maximum amount I can sell?

- I am considering further developing my product. Is there any demand for it, is it worth it?

- Where are my potential customers?

- Where is there potential?– Or the other way around:

- I am expanding. Where should I open new branches or make customer service areas smaller?

WebGIS is designed to link all relevant factors together and to show the results in a spatially distributed manner. If necessary, it can also be analyzed on a very small scale, which pays off in branch location decisions for example.

Penetration analyses work, and we can say that from experience. They help you to increase your earnings.

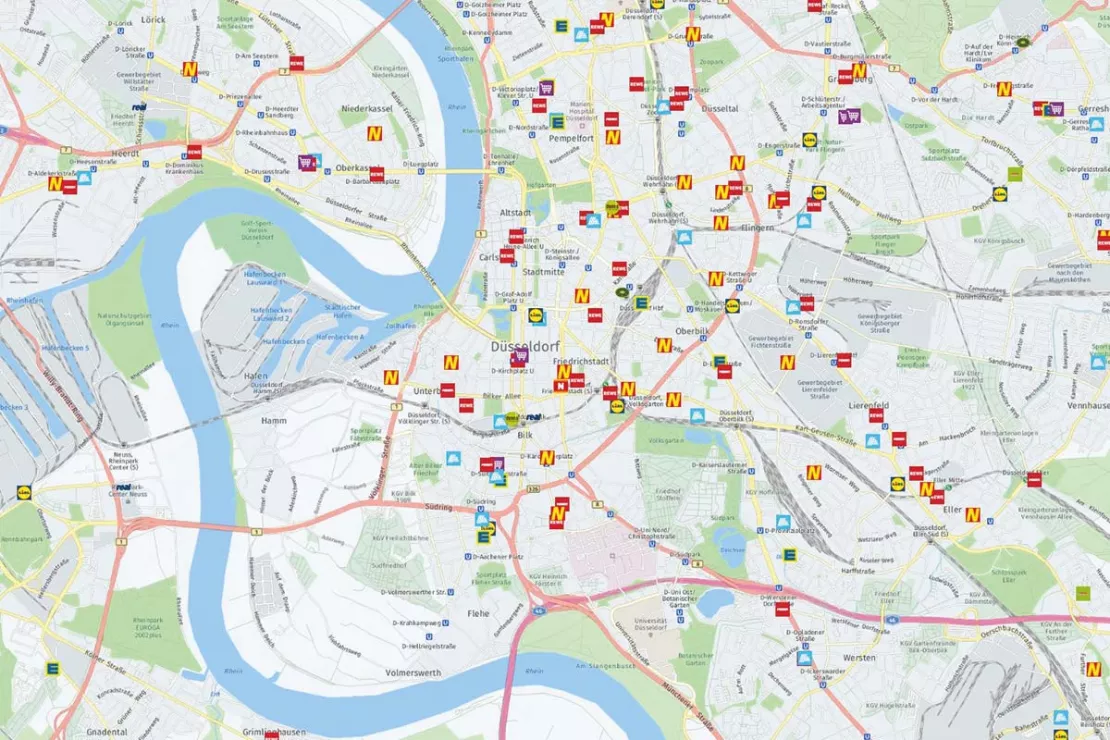

5. Competition Analysis

The competition analysis gives you an overview of your competitors and thus your own position in the market, which you can then adjust, even on a small scale. The competition analysis is often neglected, not least because it is difficult: A lot of data is not available or is secret. However, it pays off to analyze the strengths and weaknesses of your competitors and to draw conclusions for your own business.

There are numerous sources for this: Online research & other publications, personal contacts, your own sales representatives, customers, trade fairs, associations and much more.

Questions Answered by a Competition Analysis

- Where is my competition located, how is it distributed spatially?

- Where is the competition strong / weak?

- How can I optimally position my company?

- Where can I expand my market share, where is the effort not worth it because the competition is too strong?

Through a spatial analysis of your competition, you can assess your own sales potential spatially, regionally and more realistically. You can critically question your sales department and make adjustments. Also if you plan to expand, you should always analyze the competition.

Almost all of the questions mentioned so far can also be asked with the focus on the competition. The market analyses presented here overlap in practice, so it is your questions that are crucial. The advantage of WebGIS as a central system for your market analyses is also evident here: you have everything in one system and can flexibly switch between or combine disciplines.

6. Portfolio Analysis

Finally, we would like to recommend a particularly effective tool: portfolio analysis. It is ideally suited to link two or more factors of a question with each other, to recognize the relationships and to use this information to develop suitable measures and strategic decisions.

The performance of a product and its potential are traditionally compared in a matrix. According to the inventors of the methodology, the Boston Consulting Group, this matrix is called the BCG matrix: The x-axis represents the relative market share (= Performance), and the y-axis represents the market growth in% (= Potential). The products appear in the matrix as dots in four quadrants.

The graphic explains the principle:

Example portfolio analysis Boston matrix, sales areas of a manufacturer of hygiene articles

The classic Boston Matrix is used to display and analyze a company’s product range. It depicts the product life cycle that typically proceeds from Question Mark (newcomer) to Star, finally to Cash Cow and then to Poor Dog (phase-out model).

In spatial analysis, for example, sales areas and branch locations (entire branch networks) are analyzed according to the same principle. Each point in the matrix represents a branch, an existing sales area or a postal code. Suitable data is used for the performance: turnover/sales figures, number of customers serviced, sales area, etc. There are many options to choose from. The same applies to the spatial market potential.

The graphic above shows a simplified example of the analysis of the sales areas of a manufacturer of washroom hygiene products in the B2B sector. The company supplies restaurants and other business customers in the DA-CH region with soap dispensers and the like. The market is divided into sales areas that are serviced by sales representatives.

Each point represents a sales area. If an area is in the upper right quadrant (Stars), it has a high market potential and is performing well. If it is at the bottom right in the Cash Cows quadrant, it is performing well, even though the market potential is low. And so on. The matrix quickly gives an overview of the status quo: Where do I have to take action? Where is it going well? Where is the competition pushing me out? Where are customers missing?

From the interpretation of the matrix, strategic conclusions can be drawn for the management of your company and to increase your turnover.

Questions Answered by a Portfolio Analysis

Classic:

- Where are which products profitable and which are not?

- Where is it worth investing, which products should be taken out of the range and where?

Spatially:

- Which sales areas have high potential that I have not yet exhausted?

- Which branches (locations) should I close?

- Where (at the ZIP code level) can I find an especially large number of online-savvy buyers for my products, broken down by product category?

The main focus is always on the question marks. In this quadrant, the company has potential that it has not yet exhausted. So you have to take action here.

You can carry out the analysis directly in WebGIS and generate a report. At the same time, the data can of course be displayed on a map. If you assign a color to each quadrant, you can see at a glance where your Cash Cows and your “slow sellers” (Poor Dogs) are in your market.

A wide variety of data flows into the values for performance and potential. Further fine tuning is possible by weighting: Play with the weighting and see how the points move in the matrix. This helps you plan measures and make strategic decisions.

Tip!

The portfolio analysis is an ideal basis for translating strategies into operational measures. You now know where you need to take action. It is important to monitor the measures using target/actual comparisons and to adjust them if necessary.

Test for yourself - Portfolio Analyses with WIGeoWeb

A Word About the Right Data…

If you’ve read this far, it should be clear: The availability and quality of your data is a key factor for your market analysis. On the one hand, we warned you against even performing the analysis if you lacked perfect data, and on the other hand, of course, your market analysis can only be as good as the data you use. Since it can be time-consuming and/or costly to get good data, it is a matter of weighing the effort versus the benefit.

We basically differentiate between internal and external data.

Internal data is your company data, e.g. the data from your CRM system, your sales figures etc. The problem is often not the lack of availability, but exactly the opposite: you have more than enough information, but it is scattered throughout the company in different departments and IT systems. In order to be able to use the data sensibly, it first has to be collected, sorted, standardized and adjusted, or in other words: integrated. If this has not already been done, it is worth investing in your own IT or getting external help. Good data management is not set up overnight.

External data, including market data or “demographic data”, are all data that you do not generate yourself in the company, but which you need for your analyses, such as the already mentioned data on target groups, market volumes, competition etc. Much of this data is available free of charge or is open source, but sometimes it is necessary to purchase data, or it is worth it for reasons of quality and efficiency.

Here the German and Austrian markets differ fundamentally in some points, which is good news: There is good data for both markets. However, you have to know where to find it, what to look for and the granularity you need. We have compiled interesting information on demographics for you.

Conclusion

Market analyses are essential for making the right decisions in your company. The analyses presented here do not have to be performed in a specific order, but are valuable instruments that can be used as required. They answer questions from every area of your company: strategy, product development, marketing, branch location decisions and sales.

Market Analysis Tools like WIGeoWeb focus on spatial relations and have the advantage over other methods that questions can be answered very regionally and even on a smaller scale if required. For example, submarkets can be analyzed. Another advantage is that numerous analyses can be carried out with just one tool, including the six presented here.

Tip!

The clearer the facts on the table, the better you can manage your company. Market analyses provide these facts. It is often necessary to convince colleagues from other departments. Market analyses provide you with arguments!

Market Analysis Tool: Fill out the form, test it free of charge & without obligation!

- Non-binding, free test for 30 days

- Test ends automatically without cancellation

- An employee will explain the tool in a short webinar*

* Information about the free test access: Standard regions with selected data in Germany or Austria will be made available. In Germany, these regions are districts in Munich and environs, and districts of Vienna and environs in Austria. The products of WIGeoGIS are intended for companies and are not suitable for private use. If you need a one-time market analysis, we will gladly make you a service offer.

Read more:

Case Study WebGIS: This is how CLAAS uses WIGeoWeb

Potential analysis, market analysis and territory management all with one WebGIS! Yes! CLAAS has been using its own WIGeoGIS WebGIS to answer many questions since 2014.

WIGeoWeb in Real Estate Appraisal

For example, Real(e)value enhances its proven, high-performance real estate appraisal tool by spatially representing the data using WebGIS.

Case Study STIHL

The manufacturer of chainsaws and tools for the construction industry and gardening and landscape maintenance uses the location analysis software WIGeoLocation for the development of its retail network and advertising material planning.

FAQ

-

How do I best use market analyses in my daily corporate management?

A WebGIS and the spatial market analyses you can perform with it are tools for classic corporate management: lead/manage ⇒ execute ⇒ measure ⇒ adjust/control etc. The GIS provides you with the actual values and the basis for defining realistic target values. For example, you can determine your market share and, with the help of potential data, a realistic, i.e. actually achievable growth, broken down for the entire market or regionally/locally. Good, constant monitoring is important and the reports should be standardized. You can automate that with WebGIS. You can then use these reports to determine suitable management measures: sales promotion measures in marketing & sales, employee training etc. In this way you optimally support your employees and partners and ultimately increase your company’s success.

-

How do I make spatial market analysis a daily tool in my company?

Spatial market analyses can be used for individual, current questions. Used in total and regularly, they give you a holistic picture of your market and help you make better decisions for your company. A suitable tool for this is a WebGIS. Its implementation follows the general rules of well-moderated change processes: It starts with determining your needs. Once you have determined your needs, be very sure to follow a well thought-out concept and apply good project management during the implementation. The employees who will be performing the analyses are given training so that they can learn what is possible with the WebGIS. A few visible successes in the early project phase, so-called “eye-catchers”, fuel the motivation and broaden acceptance among the colleagues. Ultimately, it is about anchoring usage in your company routines. Internal marketing helps to make success visible.

-

What do I do if I don’t have the necessary data?

This is a good question and a common problem, but it should not keep you from performing analyses. A shoe retailer, for example, would like to analyze its sales in Austria by region. But he does not even know where the shoes are sold, since he only knows the data of the central warehouse in Salzburg. In practice, you try to answer the question using the best available numbers, and there are often good workarounds. Better an analysis with a larger fluctuation range than none at all!

-

Do the individual market analyses have to be performed in a certain order?

No, they are performed as needed. Besides, they are often interrelated: In the course of a customer analysis, you will also work with elements of the penetration analysis as you can also apply a potential to individual customers. For example, if you offer car cleaning as a service provider, a rental car rental with a fleet of 300 cars as a customer has greater potential for you than a second one with a fleet of 50. But do you make more sales with the first one? To categorize into A, B and C customers, consider sales figures. Here we present various basic types of analyses. In practice, the procedure is based on your questions. This can also be a combination of analyses.

-

How does regional market data help with target groups and potential analysis?

Market data can be used to examine the relationship between the regional sales success and the dominant socio-demographic characteristics in the area. If a target group is identified, we can then search for other regions that have a particularly high share of this target group we know generates success.

Are you interested in the advantages of Market Analysis Tool WIGeoWeb?