Transparent market reporting for banks with geomarketing

The Unicredit HypoVereinsbank (HVB) uses geomarketing to measure the success and potentials of its branches in Germany.

Case Study Overview

Customer: Unicredit HypoVereinsbank

Application: Potential analysis for branches

Product: WIGeoWeb

Goal: Informative location analyses to compare bank branches, analyze target groups and customer behavior

Use: Branches of the Unicredit HypoVereinsbank in Germany

Transparent market reporting for banks with geomarketing

Transparent market reporting based on geomarketing analyses is the foundation for successful sales. This applies in particular to banks as sales success is closely linked to branch network structures and branch concepts.

The Unicredit HypoVereinsbank (HVB) uses geomarketing to measure the success and potentials of its branches in Germany. Spatial market reporting helps the bank to make the right sales-strategic decisions. HVB generates such reports with the assistance, amongst other things, of WIGeoGIS software.

Over the past five years, the importance of market reporting based on geomarketing analyses has increased rapidly in banks. Expensive sales structures due to branch networks, increasing competitive pressure, changing customer behaviour and rising data volumes: These factors make it necessary to include geographic space as a dimension in analyses. The HypoVereinsbank therefore uses geomarketing software. One thing is certain for Jens-Eric Bahr: "There is no other halfway comparable tool that even comes close to precise and meaningful analysis of target groups and customer behaviour like a geomarketing tool". Bahr is a specialist for market analysis and location planning at the HypoVereinsbank. The economic geography graduate has focused his career for more than a decade on geomarketing and GIS. He regularly generates detailed market reports for the German branches of the HypoVereinsbank.

Rapid creation of detailed market reports

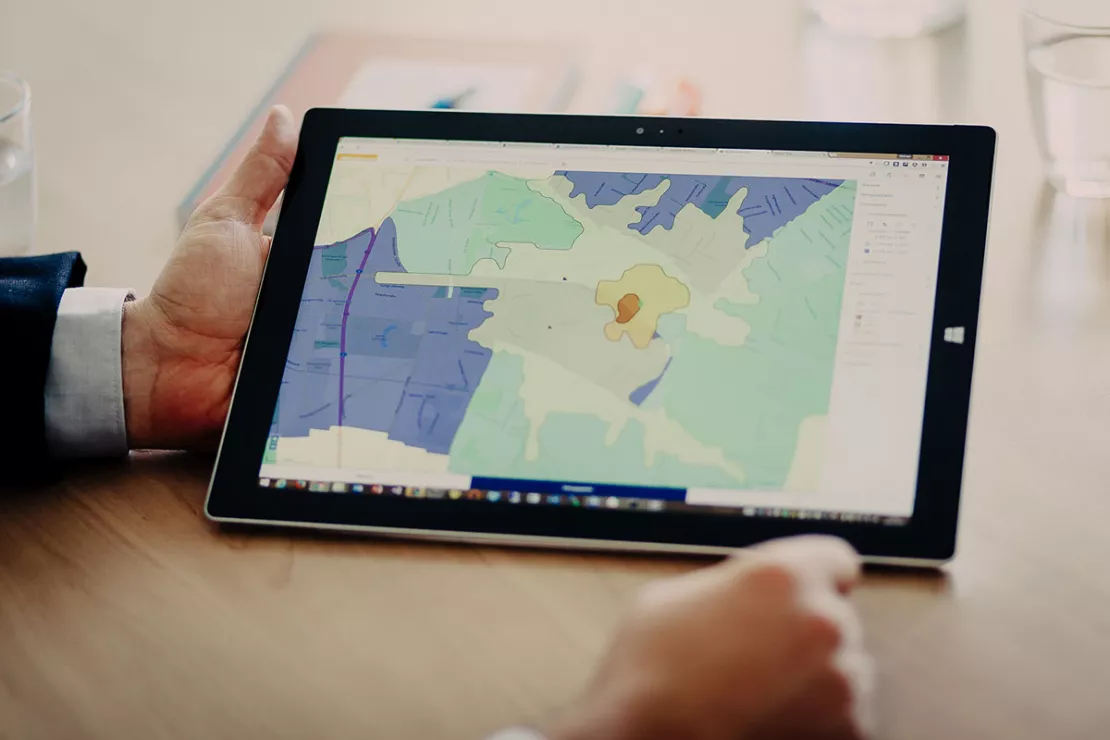

Market reporting comprehensively depicts the market comparison of sales success of a branch, in addition to controlling and other reports. A digital map clearly illustrates the actual situation. Renate Dumberger, Key Account manager at WIGeoGIS, clearly knows the strengths of digital maps and geomarketing analyses: "The geomarketing tool visualises market shares, parameters or target groups on the basis of a map, with areas coloured in according to a colour code. For instance, green represents target fulfilment. A map is quicker and easier to read than a table."The Unicredit HypoVereinsbank not only analyses market shares and parameters from a geographical aspect. It also investigates the spatial distribution of existing customers and their branch utilisation behaviour.

"We include SQL server-based data in the reporting, such as the number of transactions per branch and customer, number of customers, information on unemployment and purchasing power," explained Jens-Eric Bahr. He continued:"Without geomarketing software, market reporting would simply not be possible to this extent or depth of detail and frequency for each of our branches. In depth analyses - for example, which of our customers decide on what product with what on-site potential in which branch - are only possible with geomarketing. The outlay would also be enormously higher. Just the preparation of the analysis results would keep each branch busy for several weeks. The high automation level of the WIGeoGIS software means that this process is carried out in just a few computing hours".

For reporting, HypoVereinsbank uses WIGeoWeb, the reporting tool with spatial reference from WIGeoGIS.

Transparency at all levels Branches, subsidiaries, regions, board

The results of the geomarketing analyses are available at all necessary levels. "Each

person can obtain an overview of the situation within their own area of

responsibility - be it as a branch manager, subsidiary manager,

regional manager or board member", explained Jens-Eric Bahr, geomarketing expert at Unicredit HypoVereinsbank.

The market reporting results transparently show comparisons between branches or regions, and even the competition. "We

have the opportunity to evaluate the potentials and weaknesses of

markets, branches and locations with such geomarketing analyses. This

helps to estimate chances and risks and make the right decisions", said Jens-Eric Bahr.

Support for Your Sales Organization

Transparency in terms of opportunities and risks is especially crucial in creating the basis for a successful sales organization. “For banks, opening a branch location must be considered particularly carefully. Very high financial investments are necessary because there are extraordinary requirements in terms of security, technology and fire protection,” explains the HVB location expert.

It is therefore essential to use geographic analysis to ensure you choose the absolutely best location. The same also applies for the opposite case, namely branch closures. Renate Dumberger is familiar with this challenge from many customer projects: “Of course, a bank should not lose any customers by closing its branch location. Therefore, it is important that the customers continue to be serviced by another branch. This branch must be (almost) as easily accessible for customers as the old one. Geomarketing analyses show which branch locations are ideally suited to the customer in terms of both distance and product range. The geomarketing software calculates a recommendation and automatically assigns the customer to a new branch. It is also necessary to assign customers to branches when, for example, banks segment their customers or develop new products.”

A bank branch is not only characterized by its location. Facilities, product range and personnel are all factors that are determined by the geographical location. Jens-Eric Bahr is familiar with that as well: “HypoVereinsbank offers highly specialized products. We have experts in the business customer segment who, for example, deal exclusively with customers from the medical professions. Healthcare experts are of course only available in selected branches. Geomarketing analyses show us which branches have the highest volume and potential of practices and businesses and thus of target group-specific consultation, for example the financing of practices or their special medical equipment.”

Professional and needs-based consultation is the central unique selling point of bank branches. Online and mobile banking as well as financial providers from outside the industry can only offer this to a limited extent. It is therefore crucial that bank branches align their consulting services and personnel to the local conditions. This is best done with geomarketing analysis.

Banking industry - further case studies and information

Unicredit Bank Austria: Geomarketing optimises sales structures

Using WIGeoGIS geomarketing software, UniCredit Bank Austria is optimising its sales structures based on physical branches.

Branch Marketing with Geomarketing at Erste Bank

Erste Bank´s branch marketing department has for years relied on a web-based branch and marketing information system from WIGeoGIS.

Crédit Agricole: Market potentials via GIS

To keep up with the constantly growing needs of microgeographical analyses, the Polish subsidiary of Crédit Agricole uses a GIS by WIGeoGIS.

Location Analyses for Banks and Savings Banks

With location analyses, banks and savings banks make better and more informed decisions for branches, customers and marketing for flagship locations, service centers and ATMs.

WIGeoWeb: Fill out the form, test it free of charge & without obligation!

- Non-binding, free test for 30 days

- Test ends automatically without cancellation

- An employee will explain the tool in a short webinar*

* Information about the free test access: Standard regions with selected data in Germany or Austria will be made available. In Germany, these regions are districts in Munich and environs, and districts of Vienna and environs in Austria. The products of WIGeoGIS are intended for companies and are not suitable for private use. If you need a one-time market analysis, we will gladly make you a service offer.